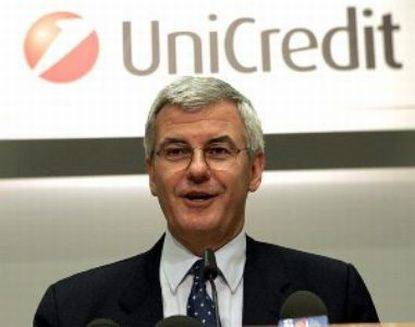

Alessandro Profumo and His Resignation

On September 21, 2010 Italian bank UniCredit, SpA announced the resignation of its Chief Executive Officer Alessandro Profumo, who has been at the helm of the company since 1997.

The board and Mr. Profumo “agreed that after fifteen years, the time was right for a change in leadership.” Despite this conventional official statement, the former CEO attempted to maintain his job at UniCredit, but allegations that he had not told the company’s board and shareholders about growing Libyan investments within the company ultimately cost him his job.

His brilliant career began with a degree from Milan’s Bocconi Business University and a job at Italy-based Banco Lariano, where he worked from 1977 to 1987. In December 1987, he joined McKinsey & Co. as a consultant to financial companies. He later joined Bain, Cuneo & Associati. In 1991, Mr. Profumo left the field of company consultancy to join Riunione Adriatica di Sicurtà (RAS), where he was named General Mmanager for the banking and banking support sectors. He became CEO of Credito Italiano in 1997, and restructured the lender into UniCredit. He led it through an enormous expansion, moving eastward with the 2005 acquisition of Munich-based HvB and expanding its Italian business with the purchase of Capitalia.

Mr. Profumo, Europe’s longest-serving bank CEO, transformed UniCredit from a regional bank to a pan-European player with operations in 22 countries. After thirteen years following a successful global strategy and playing an important role outside of Italy, Alessandro Profumo’s resignation is viewed by some analysts as the first step in a battle for political control of Italy’s largest bank. Interim bank operations are now in the hands of Dieter Rampl, the bank’s Chairman. Rampl also has the mandate to identify and propose Profumo’s successor. Despite his experience and ability, Mr. Profumo was sometimes regarded as overly-ambitious, and was dubbed “Mr. Arrogance” by the Italian press. Under his leadership, the company’s market capitalization rose from 1.5 billion to 37 billion Euros and it remained profitable even during the global financial crisis.

Mr. Profumo’s international strategy as the head of UniCredit was to increase the bank’s capital through the period of global economic crisis. He thought that the bank needed the money that would arrive from Libya; the Libyan Investment Authority, a sovereign wealth fund, recently increased its holding in UniCredit by 0.5% to 2.6%, while the Central Bank of Libya holds an almost 5% stake in the bank. The Libyan Central Bank is now UniCredit’s third-largest shareholder, while Libya’s sovereign wealth fund is the eighth largest. This is said to have alarmed politicians, regulators, and shareholders in Italy, who have expressed concern whether UniCredit might come under Libyan control.

Mr. Profumo, however, had reportedly defended the Libyan investments and praised its support for the bank, according to his global strategy. His statements, though, did not convince the UniCredit Group foundation, whose board members included supporters of the right-wing Northern League party and who expressed reservations about Libya’s growing role as a shareholder. These reservations added to the board’s opposition to the increasing power that Libyans demonstrated over the summer.

The final straw occurred last August, when Chairman Rampl is said to have turned against Profumo for not informing him about the Libyan Investment Authority’s stake purchase. Economic media analysts think that the standoff was not over Mr. Profumo’s competence, but rather a fight to gain political control in UniCredit which includes the Northen League claiming power over northern Italian banks. Verona Mayor Flavio Tosi, the foundation member who has been most critical of Alessandro Profumo’s leadership, told reporters that other shareholders have the same concerns about Libya’s role in the bank. The city of Verona is the largest shareholder in the Cariverona Foundation, Unicredit’s fourth largest investor. “It seems to me, reading the media reports, that our worries are shared by other members,” Mr. Tosi told the news agency ANSA.

Flavio Tosi also accused the bank of focusing on business abroad at the expense of Italian enterprises that still need help recovering from the world economic crisis. Mr. Profumo defended himself from accusations by telling foreign journalists that a Libyan sovereign fund acted on its own to take a stake in the bank and that the move was autonomous and not solicited, executed by purchasing shares on the open market.

Alessandro Profumo’s exit from UniCredit may be seen as a significant victory for the Foundations and for the federalist Northern League party, which is a strong ally in Prime Minister Silvio Berlusconi’s conservative government. The League controls two of the regions in which the Foundations are based. At the moment, the situation is continuously evolving and so many players are involved in a covert war to control the bank, although it could be argued that the war is not particularly concealed.

There are three major players: various Foundations that want to change the company’s global character to one that is local and more deep-rooted in the northern territory; Libyan investors who have increased their influence within the bank; and the Northern League (and by extension, Berlusconi himself) that recognizes the importance of having a direct way to increase its political power.

It appears to be a game centered on taking control over the entire Italian banking system. Many analysts are stressing the need for a quick replacement, and the Bank of Italy and the Economy Ministry are worried about the economic impact of instability at UniCredit. In order to reassure its shareholders, in an interview with the Corriere della Sera newspaper, Dieter Rampl denied that politics have any influence on the bank. “Anyone who thinks that politics can determine the choices made at UniCredit is wrong,” he said. He also declined to comment on Mr. Profumo’s successor, except to say that the search would conclude in a matter of weeks and that his replacement could come from outside the company.

Milano Finanza newspaper reported that Economy Minister Giulio Tremonti wanted Italian institutional shareholders to propose Treasury Director General Vittorio Grilli as CEO. Possible successors also include former Goldman Sachs executive Claudio Costamagna; Matteo Arpe, former executive of Rome’s Capitalia bank, which was bought by UniCredit in 2007; Merrill Lynch top banker Andrea Orcel; and Royal Bank of Scotland Deputy CEO of global banking and markets Marco Mazzucchelli.

i-Italy

Facebook

Google+

This work may not be reproduced, in whole or in part, without prior written permission.

Questo lavoro non può essere riprodotto, in tutto o in parte, senza permesso scritto.